What a difference a decade makes: the GA boom in statistics

Air Facts Journal

General aviation is growing. That simple statement would have been unremarkable to a pilot in the 1960s or 1970s, as surprising as saying the sun rose in the east that day. But for anyone who learned to fly after about 1990, and especially between 2008 and 2016, it’s a shocking thing to admit. Yet that is exactly what is happening right now, as data from a wide variety of sources show.

The growth of the GA industry in 2024 is both broad-based, covering everything from two-seat piston trainers to 15-seat business jets, and sustained, with over five years of upward momentum (excluding a few Covid-induced drops during 2020). This suggests the trend is more than a statistical artifact or a temporary bubble. It also matches the gut feel of many pilots, who are sharing the pattern with more airplanes than five or ten years ago.

Before you pop the champagne, though, there are some important details to understand.

The training boom

The most obvious driver of increased GA activity is flight training, and sure enough, the data show that it’s up significantly. According to the annual FAA activity survey, instructional flying hours increased 71% from 2012 to 2022, far more than the overall growth in flying. As a share of all hours flown, instructional jumped from 15.3% to 23.7%, meaning nearly a quarter of all GA activity right now is flight training.

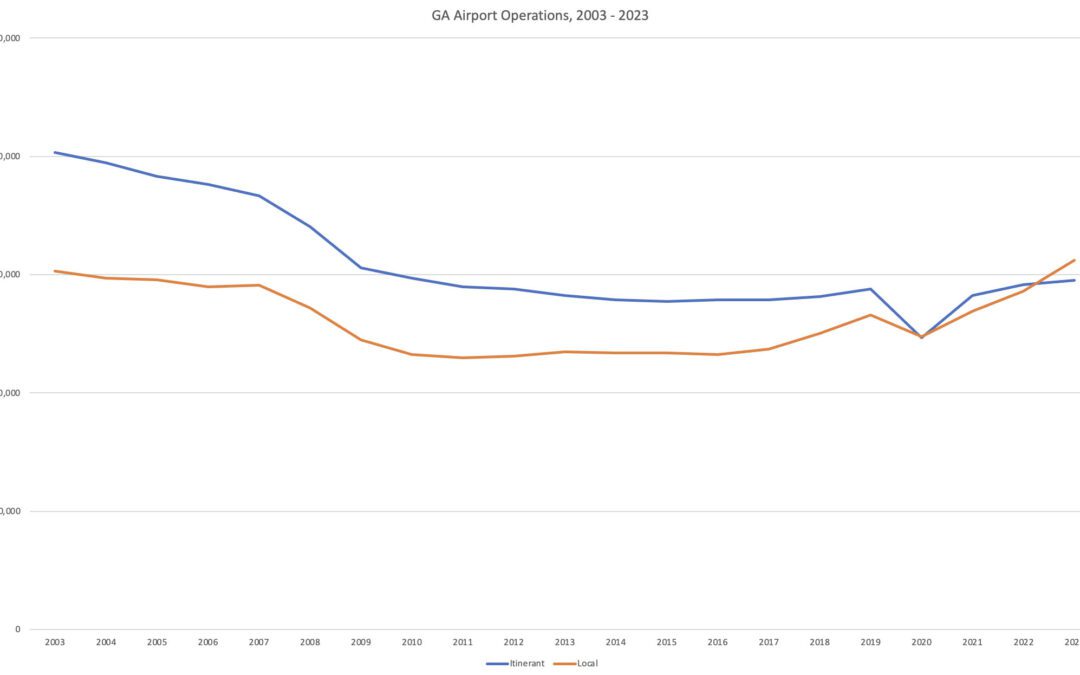

Another way to look at flight activity is GA airport operations, pulled from the FAA’s OpsNet website. This is a good way to track actual operations, since it does not rely on voluntary response surveys or flight plan data (more than half of all piston airplanes fly without a flight plan of any kind). OpsNet data tracks both local flights and itinerant flights, which are defined as “Operations performed by an aircraft, either IFR or VFR, that land at an airport arriving from outside the airport area, or depart from an airport and leave the airport area.” For the first time ever, local flights passed itinerant flights in 2023. That suggests that local training flights are powering much of the increase in flights, not cross-country travel.

A more direct way to track flight training volume, although not necessarily flying, is Private Pilot Knowledge Tests. This is the first step for many new pilots and here the trend is unmistakable: test volume has nearly doubled since 2012.

All those knowledge tests are leading to certificates, too. While the flight training dropout rate is still high at many flight schools, original Private Pilot certificate issuances are up 47% over 2012, with 24,405 issued in 2022. That’s a lot of new pilots, at least compared to recent years.

Why the boom in training? The force drawing all these people into flight training right now is the once-in-a-generation peak in airline pilot hiring. Worldwide airline growth, early retirements during Covid, and long-term demographic trends have combined to create a real shortage of airline pilots. The market has worked its magic, as this shortage has led to skyrocketing pay packages and increased interest in aviation careers. Data from Future & Active Pilot Advisors (FAPA ) shows that the recent boom is truly unprecedented:

The turbine boom

Dig a little deeper into FAA reports and it’s clear that the current growth cycle is not completely driven by Cessna 172s and Piper Archers. In terms of active airplanes, jets have surged by 37% over the last decade, from 11,793 to 16,126, even while active piston airplanes have dropped slightly.

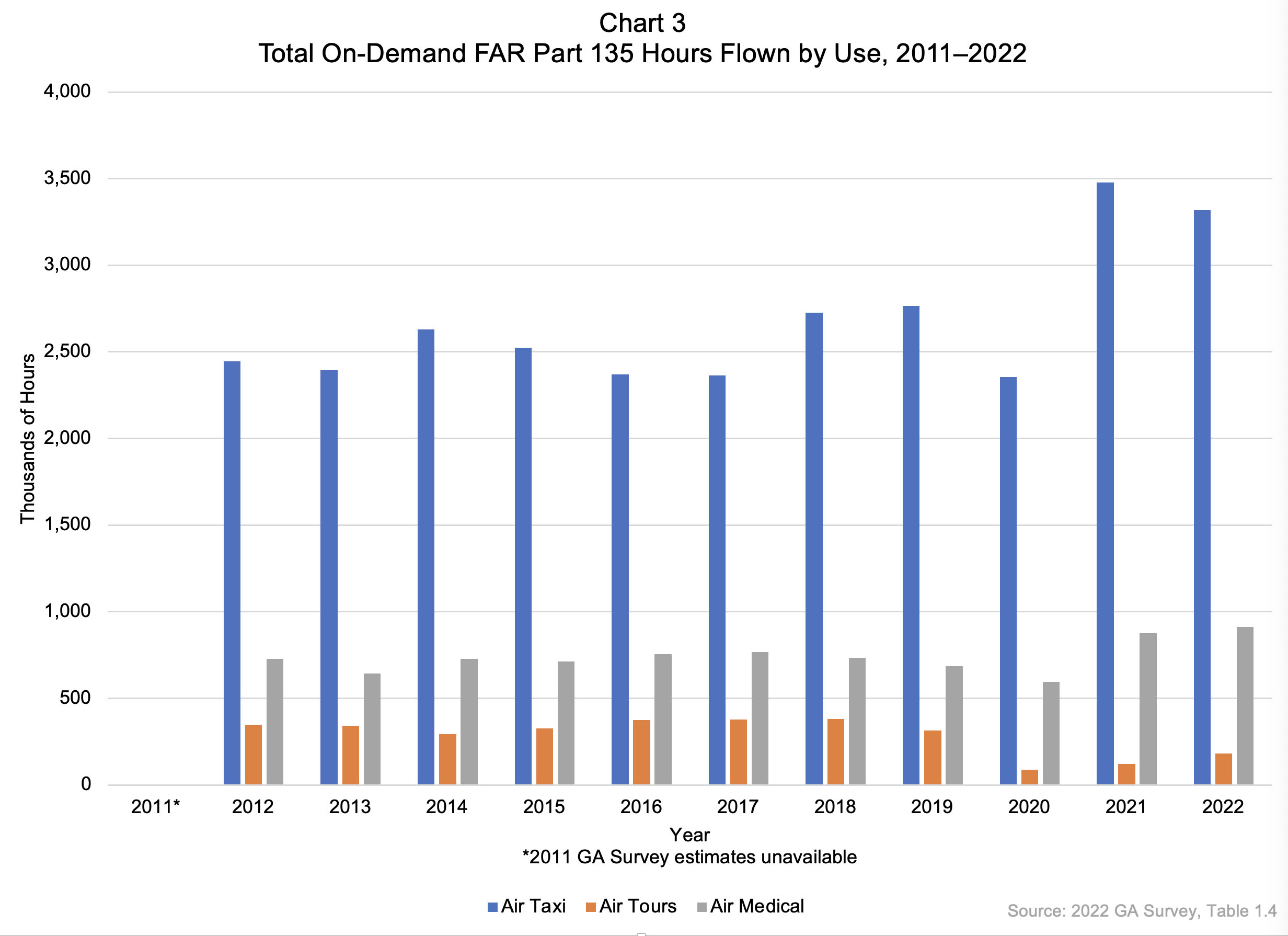

Looking at hours flown, the split between piston and turbine becomes even more stark. Business jets flew 5.24 million hours in 2022, compared to 3.42 million in 2012, led by Part 135 operators (36% over growth that time). Covid travel restrictions and overall poor airline service have presented something of an open goal for companies like NetJets and WheelsUp, and they seem to be taking advantage.

These turbine airplanes work hard, too. While jets account for 90% fewer airplanes than pistons, they average three times more hours per year (325 vs. 100).

Turboprops have grown more slowly than jets, but beneath that headline it’s clear that single engine turboprops have arrived. Airplanes like TBMs, PC-12s, and Meridians are slowly replacing King Airs and Conquests; they flew 1.63 million hours 2022, compared to 1.37 million in 2012. In 2022, 55% of GA turboprops were single engine, up from 49% in 2012. Among owner-flown airplanes this is almost certainly higher, since many twin turboprops these days are part of fractional or charter fleets.

In addition to turboprop twins, single engine turboprops are also slowly pushing piston twins into a training niche. This category, led by trusty designs like the Seminole and Cessna 310, flew just 1.43 million hours in 2022, down from 1.77 million hours in 2012.

Is the glass half empty?

Of course there are important details to consider, and those pilots who survived previous downturns may be itching to jump in with a reminder about how quickly trends can reverse. Look closely and the industry does indeed seem to be at an inflection point. For a start, the airline pilot hiring boom has probably peaked, as many regional airlines and investment banks have pointed out recently. Hiring at major US airlines was down almost 25% in January and February 2024 compared to the previous year. Some airlines have even paused hiring completely, including big names like Southwest and FedEx.

But while the headlines are occasionally negative, pilot hiring is hardly weak. Compared to 2018-2019, pilot hiring is still up nearly 100% in early 2024. The reality is that the acute phase of the shortage (driven mostly by Covid) is over, but the chronic phase (driven mostly by long-term demographics) is still very much a factor. In fact, some of the recents struggles have more to do with delayed airplane deliveries, in particular the Boeing 737 MAX, than changes in demand. One look at the long term hiring trend shows that the trend may have plateaued, but at a very high rate.

The more serious concern is that the training boom is hiding weakness in owner-flown GA airplanes, the classic Cessna 182 and Beechcraft Bonanza operators who use light airplanes for a mix of family and business transportation. Once again, the headlines are not great: Beechcraft essentially stopped taking orders for Bonanzas and Barons last year, Cessna shipped just 66 Skylanes last year, and Icon recently filed for bankruptcy.

It’s more than just headlines that support the glass half empty theory; FAA data shows some worrying trends. Original certificate issuances (meaning a new certificate or rating, not a reissue) are way up for Student pilots, from 49,000 in 2014 to over 69,000 in 2023, but active Private pilots are down from 174,883 to 167,711. Measuring “active pilots” is hard, but the trend suggests all those student pilots are not leaving a lasting impact on GA—we’re losing as many Private pilots as we’re gaining. If nothing else, most students are moving right on to a Commercial or ATP certificate, passing through GA as they move into pro pilot jobs. That’s good for the industry while they’re training, but doesn’t make much of a long term impact.

And of course if you want to argue that the glass is completely empty, just look at FAA statistics from the late 1970s and early 1980s: today’s 167,000 active Private pilots pale in comparison to the 357,000 in 1980!

But that’s an unfair comparison, a bubble that is never coming back. For now we can confidently say that GA is growing and has been for nearly a decade. New people from all walks of life are coming into the aviation industry, and flying is considered cool again, whether it’s bush pilots on YouTube or Tom Cruise on the big screen. Bonanzas and Skylanes may not be flying off the shelves, but Cirrus SR20s and SR22s are: over 600 were delivered in 2023. Sure they’re expensive, but the company has been successful by responding to customer desires and constantly improving their product. They’ve found a market, even at $1 million per airplane.

The cycle may soon turn, but the pessimists would do well to remember what poet Randall Jarrell once wrote: “The people who live in a golden age usually go around complaining how yellow everything looks.”

The post What a difference a decade makes: the GA boom in statistics appeared first on Air Facts Journal .